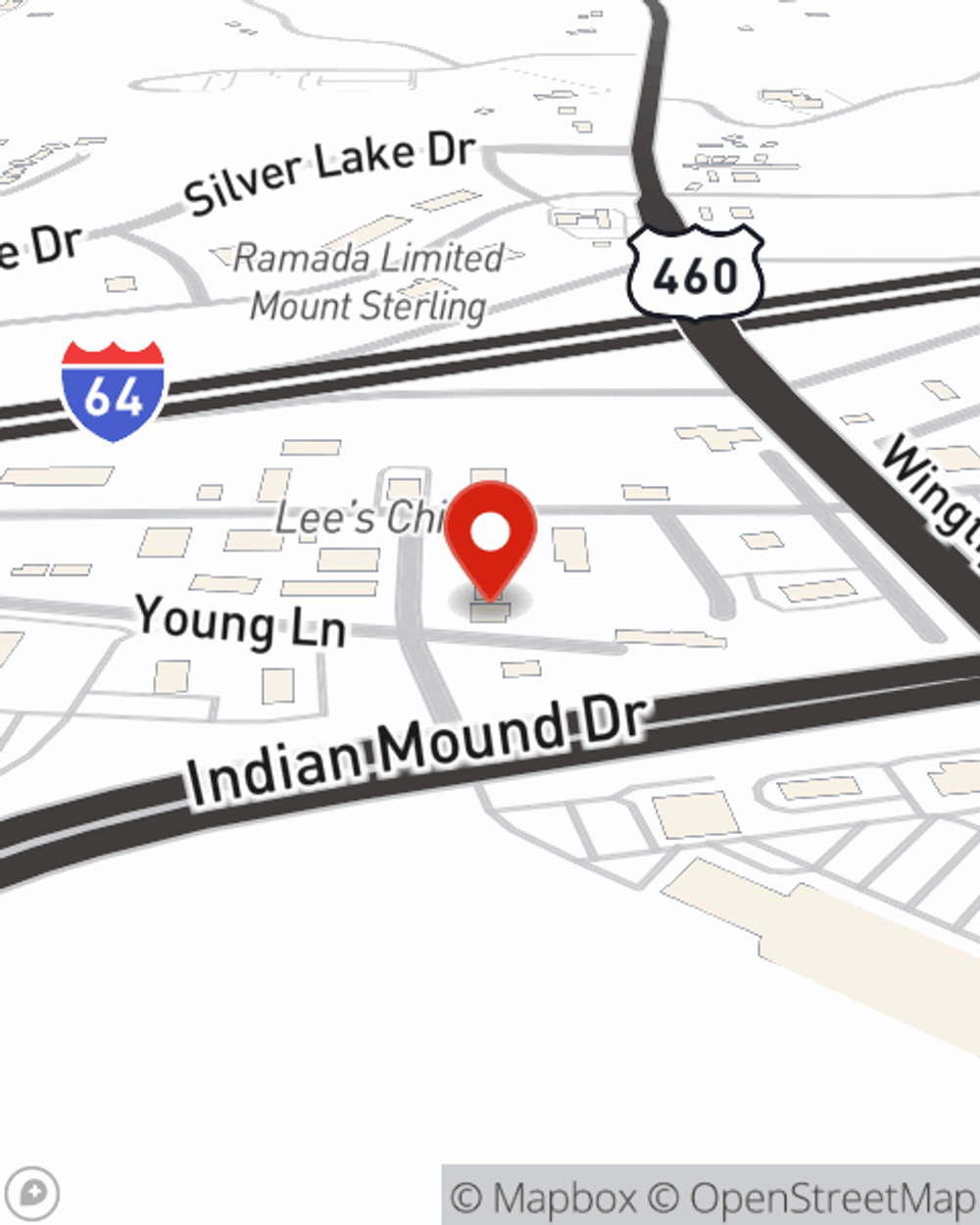

Business Insurance in and around Mount Sterling

Looking for small business insurance coverage?

Insure your business, intentionally

- Bath Co

- Menifee Co

- Powell Co

- Morgan Co

- Camargo

- Jeffersonville

- Wolfe Co

- Rowan Co

- Clark co

Business Insurance At A Great Value!

Whether you own a a flower shop, a hair salon, or a veterinarian, State Farm has small business coverage that can help. That way, amid all the various options and moving pieces, you can focus on your next steps.

Looking for small business insurance coverage?

Insure your business, intentionally

Customizable Coverage For Your Business

Your business thrives off your commitment determination, and having dependable coverage with State Farm. While you make decisions for the future of your business and put in the work, let State Farm do their part in supporting you with artisan and service contractors policies, worker’s compensation and business owners policies.

As a small business owner as well, agent Brooke Seale understands that there is a lot on your plate. Call or email Brooke Seale today to discover your options.

Simple Insights®

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Brooke Seale

State Farm® Insurance AgentSimple Insights®

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.